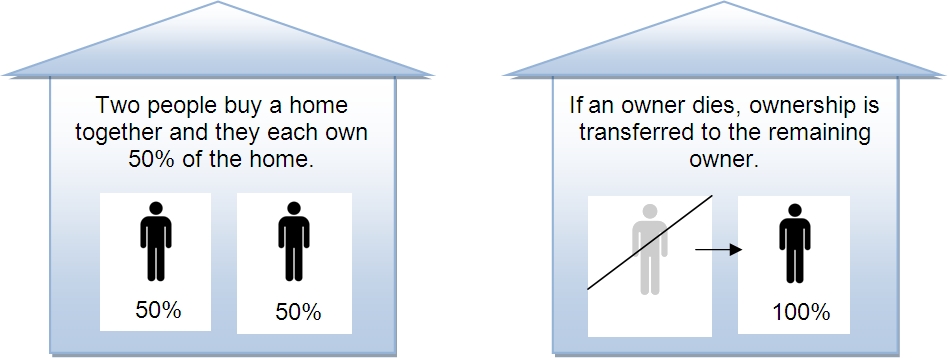

If there is only one owner, then there is no other owner that can hold the right to acquire the property at that owner’s death.Ī right of survivorship also requires human owners (often called natural persons in legal material). What is a Right of Survivorship?Ī right of survivorship is a right given to one owner to inherit property on another owner’s death.Īs the definition implies, a right of survivorship requires at least two owners. This allows the property to owner to avoid probate at death without sacrificing control over any portion of the property during life. Both TOD deeds and lady bird deeds avoid probate at death without transferring ownership of the property during life. The key to making it work is to ensure that the property is titled with right of survivorship.Īs discussed below, although adding someone to a deed with right of survivorship does involve probate, a transfer-on-death (TOD) deed or lady bird deed is usually a better alternative. If done correctly, adding someone to the title can avoid probate. To avoid the drawbacks of transferring the entire property, many property owners prefer to add someone to the title to the property.

And there may also be income tax and gift tax consequences associated with outright transfers. Most people do not want to give their property away while they are still alive. Outright transfers involve a complete loss of control and use of the property. Because you do not own the property at your death, there is no need to probate your estate to transfer the property.

A lifetime gift of the entire property removes the property from your probate estate.

For example, you may transfer a timeshare or vacation home to your children, retaining no ownership interest. One way to avoid probate is to simply transfer the property to someone else. As discussed in How to Avoid Probate, the key to avoiding probate is to arrange your assets so assets so everything you own either passes automatically to someone at your death or can be transferred without court involvement.

0 kommentar(er)

0 kommentar(er)